This report contains key findings from the Public Retirement Research Lab's (PRRL) August 2020 survey of recordkeepers aimed to explore the public sector DC plan response to CARES Act distribution provisions, and participant saving and investment behavior during the pandemic. Recordkeepers that responded to the survey represented 75,000 public sector DC plans and more than 10,000,000 participants as of July 2020.

Among key findings from the survey:

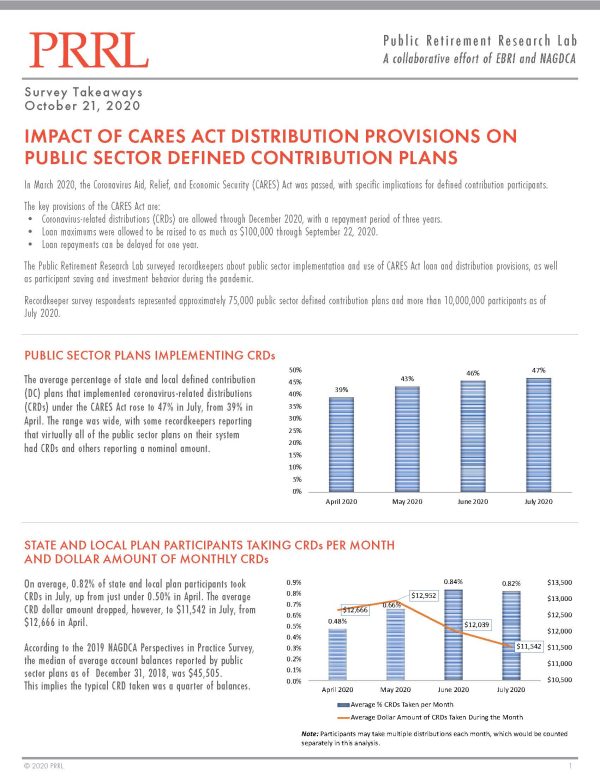

- COVID-19 related distributions (CRDs) rose steadily from April to July, when they reached 47%. Some respondents reported that virtually all of the plans on their system had taken CRDs, while other reported a nominal amount.

- On a monthly basis, less than 1% of state and local DC plan participants took CRDs, with an average distribution of between $11,542 and $12,952.

- The prevalence of deferred loan repayments implemented by state and local plans was considerably greater than the implementation of higher loan maximums throughout the period observed.

An important takeaway from the data is that public sector defined contribution participants have largely stayed the course; not a lot have used these provisions. Although, when distributions have been taken, they are relatively large, which is concerning. The questions remains - will we see a rise in distributions as we near the end of the year?

- Version

- 524.26 KB File Size

- October 20, 2020 Create Date

- August 31, 2023 Last Updated