OCTOBER 2020

NAGDCA Connect

NAGDCA is pleased to launch our new online learning series, NAGDCA Connect – Virtual Engagement and Learning Series. NAGDCA Connect is an online interactive learning series launching in October, coinciding with National Retirement Security Month. Convening the NAGDCA community is more important than ever; therefore, we’re developing a variety of topical sessions and small group discussions to provide a new opportunity to learn and network with your peers.

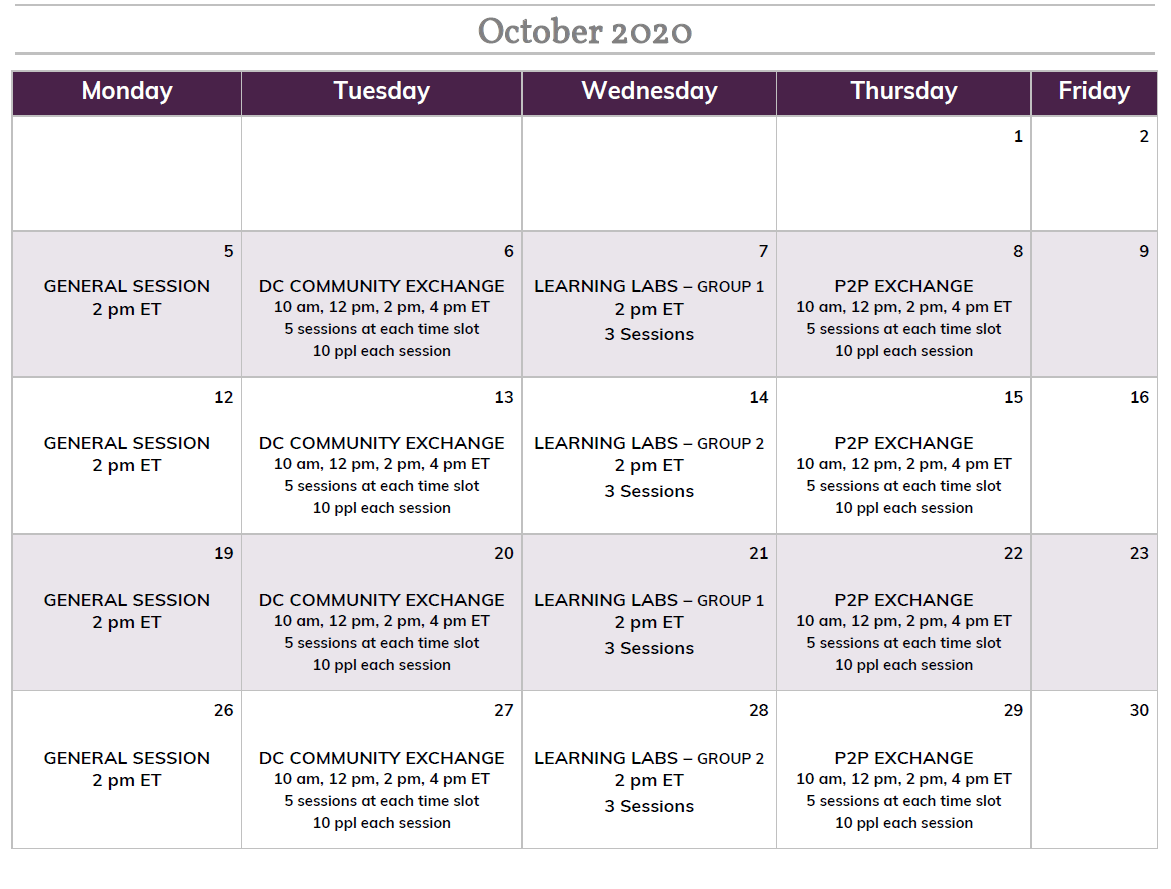

During the month of October, registrants will have access to the following:

- Mondays – General Sessions

- Tuesdays – DC Community Exchange (small, moderated group discussions comprised of industry representatives and plan sponsors to discuss issues/challenges)

- Wednesdays – Learning Labs

- Thursdays – Peer-to-Peer Exchange – reserved for government registrants only (small, moderated group discussions comprised of plan sponsors to share best practices, ask questions and learn from their peers)

General sessions and learning lab sessions will begin at 2:00 p.m. ET, and registrants may select from multiple time slots for the exchange sessions on the registration form.

Connect On-demand

Miss the live series? Click here to purchase access to Connect on-demand content for just $100.00!

To access recorded sessions, click below to log in to the Connect event platform. The event platform is where you will find general session and learning lab recordings, learn about our sponsors, download presentations, and access thought leadership pieces from our Visionary sponsors.

To access Recorded Sessions –

- Log in to the event platform with your NAGDCA credentials.

- Navigate to the session.

- Click “VIEW RECORDING!” found under “Materials.”

Registration Information

This event has passed but attendees can still access the event platform with the recorded sessions, sponsor profiles and more.

Click here to purchase access to Connect on-demand content for just $100.00!

| Member Type | Registration Fee |

|---|---|

| Government Member | $100.00 |

| Government Non-member¹ | $100.00 |

| Industry Member | $150.00 |

| Industry Non-member | $150.00 |

¹ Government Non-member registration includes complimentary NAGDCA membership beginning on the date of purchase through Dec. 31, 2020. Only available to entities who have not been members within the past three years.

Questions? Please email registration@nagdca.org if you have conference registration questions.

Click here to purchase access to Connect on-demand content for just $100.00!

Click here to log in to the event platform to access recorded sessions.

Week 1 | October 5 – 8

MON, OCT 5

|

KEYNOTE & GENERAL SESSIONThe way forward: Why diversity and inclusion matters Is retirement a demographically neutral event? As workforces evolve and have affinity groups, how can retirement topics reflect that change? How do we create a more inclusive financial environment for diverse populations? From shifting household roles to generational labels to immigrating cultures, each have unique perspectives and points of reference that warrant understanding. Dissecting common stereotypes and belief systems associated with gender, race, or age may seem difficult but it is not impossible. This panel will discuss some of the common misperceptions and biases that exist and how to re-frame the conversation so that everyone in your organization hears a retirement message to which they can relate. Speakers:

|

TUES, OCT 6

|

DC COMMUNITY EXCHANGE – optionalDC Community Exchanges are virtual small group (10 ppl) moderated discussion sessions that are open to all attendees every Tuesday in October. The DC Community Exchanges offer an opportunity to connect with your peers while discussing various topical questions. The exchange sessions are optional, and attendees may sign up on the event registration form. NAGDCA will reach out in late August/early September to confirm your participation. |

WED, OCT 7

|

LEARNING LABS – GROUP 1At a crossroads: Health and Wealth Public sector retirement plans have a wide range of defined contribution plan structures and the differences between plan types can be confusing. Now, some organizations are adding health accounts, such as HSAs and HRAs to the savings mix – further complicating the picture for participants. Our panel will discuss the intersection between health and wealth and how to guide your participants to utilize these incredibly powerful savings vehicles. Speakers:

Practical Innovations – Easy Ways to Turbocharge Your Program Who knew stepping outside the box could be this easy? Just us for a conversation about practical ways to help your program shine. We’ll provide tips, and hopefully some inspiration, for fresh ways to look at ongoing challenges. Elevate your plan on relevant topics including plan design, governance and staffing, vendor partnerships and more. Join NAGDCA for a conversation with NAGDCA President Sandy Blair, CalSTRS; Alex Hannah, ICMA-RC; Beth Kushner, City of New York; and Steven Montagna, City of Los Angeles. Show me the money – a focus on fees In recent years, government plan sponsors have been focused on fees – their correlation to service and impact on value. This is a positive trend that shows true sponsor commitment to their fiduciary responsibility. However, lower fees are not always without costs or impact. This panel will explore the why behind those who have successfully lowered their fees and others who have chosen higher fees in hopes of achieving better member outcomes or providing enhanced services. Speakers:

|

THURS, OCT 8

|

P2P EXCHANGE – optional; plan sponsors onlyP2P Exchanges are virtual small group (10 ppl) peer-to-peer moderated discussion sessions that are only open to government attendees every Thursday in October. The exchange sessions are optional, and attendees may sign up on the event registration form. NAGDCA will reach out in late August/early September to confirm your participation. |

Week 2 | October 12 – 15

MON, OCT 12

|

GENERAL SESSIONTalk is cheap: How to drive change through strategic communications All employees must understand their retirement plan options in order to effectively plan for their future, but successfully communicating with them remains a challenge for most. This session will explore the unique obstacles public plan sponsors face when engaging with participants, strategies for overcoming those obstacles, and the importance of measuring the right things. This panel will share:

Speakers:

|

TUES, OCT 13

|

DC COMMUNITY EXCHANGE – optionalDC Community Exchanges are virtual small group (10 ppl) moderated discussion sessions that are open to all attendees every Tuesday in October. The DC Community Exchanges offer an opportunity to connect with your peers while discussing various topical questions. The exchange sessions are optional, and attendees may sign up on the event registration form. NAGDCA will reach out in late August/early September to confirm your participation. |

WED, OCT 14

|

LEARNING LABS – GROUP 2Auto Features: Set it and forget it? Automatic enrollment is one of the most effective ways to increase participation in workplace retirement plans. Yet according to NAGDCA research, half of the states wholly prohibit automatic enrollment for public employees, while another 16 limit it in some form. This panel will explore both sides of the issue. First, we will hear about the two-year journey one organization took to implement a new automatic enrollment program. In contrast, we will hear from a plan that was prohibited from using automatic enrollment but found alternative methods for increasing plan participation. So regardless of your state’s laws, there are methods and paths to improve your plan’s outcomes. Speakers:

Seeking the Holy Grail – Holistic Financial Wellness COVID-19 has put a magnifying glass on a huge problem: the financial fragility of the American workforce. Prior to the pandemic, half of Americans lived paycheck-to-paycheck, with many treating credit cards as an emergency savings option. Forty-one percent of Americans were unable to cover an unexpected $400 expense without borrowing money or selling a personal item. These staggering statistics demonstrate the struggle Americans face not only in saving for retirement, but in achieving financial stability in their daily lives. This panel will focus on the current state of financial wellness needs of government workers and the available programs to meet these needs: where they stood pre-COVID-19 and how they have been impacted since. Learn:

Speakers:

To catch a thief: Fraud and cybersecurity in a connected world Hacking, breaches, viruses, ransomware – cybersecurity is scary. But what action can you take as a plan sponsor to both prevent attacks and respond to them when they occur? Our panel of experts will discuss the latest tactics to keep the bad guys at bay that you can take back to the office and immediately implement to protect unauthorized access to your plan and your participants. Speakers:

|

THURS, OCT 15

|

P2P EXCHANGE – optional; plan sponsors onlyP2P Exchanges are virtual small group (10 ppl) peer-to-peer moderated discussion sessions that are only open to government attendees every Thursday in October. The exchange sessions are optional, and attendees may sign up on the event registration form. NAGDCA will reach out in late August/early September to confirm your participation. |

Week 3 | October 19 – 22

MON, OCT 19

|

GENERAL SESSIONRetirement Income: Funding the encore NAGDCA members work hard to help their participants save for retirement. However, what happens the day after retirement? While many plan sponsors may advocate for keeping assets in the plan, they need to help participants spend their money in a way that meets their goals using a personalized approach. Views on retirement income are rapidly changing and our panel of the industry’s top minds will break down the problem and offer solutions that help your participants enjoy the money they worked so hard to save in what is likely their second act. Speakers:

|

TUES, OCT 20

|

DC COMMUNITY EXCHANGE – optionalDC Community Exchanges are virtual small group (10 ppl) moderated discussion sessions that are open to all attendees every Tuesday in October. The DC Community Exchanges offer an opportunity to connect with your peers while discussing various topical questions. The exchange sessions are optional, and attendees may sign up on the event registration form. NAGDCA will reach out in late August/early September to confirm your participation. |

WED, OCT 21

|

LEARNING LABS – GROUP 1At a crossroads: Health and Wealth Public sector retirement plans have a wide range of defined contribution plan structures and the differences between plan types can be confusing. Now, some organizations are adding health accounts, such as HSAs and HRAs to the savings mix – further complicating the picture for participants. Our panel will discuss the intersection between health and wealth and how to guide your participants to utilize these incredibly powerful savings vehicles. Speakers:

Practical Innovations – Easy Ways to Turbocharge Your Program Who knew stepping outside the box could be this easy? Just us for a conversation about practical ways to help your program shine. We’ll provide tips, and hopefully some inspiration, for fresh ways to look at ongoing challenges. Elevate your plan on relevant topics including plan design, governance and staffing, vendor partnerships and more. Join NAGDCA for a conversation with NAGDCA President Sandy Blair, CalSTRS; Alex Hannah, ICMA-RC; Beth Kushner, City of New York; and Steven Montagna, City of Los Angeles. Show me the money – a focus on fees In recent years, government plan sponsors have been focused on fees – their correlation to service and impact on value. This is a positive trend that shows true sponsor commitment to their fiduciary responsibility. However, lower fees are not always without costs or impact. This panel will explore the why behind those who have successfully lowered their fees and others who have chosen higher fees in hopes of achieving better member outcomes or providing enhanced services. Speakers:

|

THURS, OCT 22

|

P2P EXCHANGE – optional; plan sponsors onlyP2P Exchanges are virtual small group (10 ppl) peer-to-peer moderated discussion sessions that are only open to government attendees every Thursday in October. The exchange sessions are optional, and attendees may sign up on the event registration form. NAGDCA will reach out in late August/early September to confirm your participation. |

Week 4 | October 26 – 29

MON, OCT 26

|

GENERAL SESSIONHealth, Wellness and Financial Security Today’s 65-year-old can expect to live another 20 years, according to the Social Security Administration. Similarly, the bottom 20% of older adults have no assets; in fact, some are in debt. For a 65-year old couple, healthcare expenses can reach $265,000-$349,000 during retirement (EBRI health expense report) yet 4 out of 5 people cannot accurately estimate how much they expect to pay for health care in retirement (Nationwide annual Health Care and LTC Survey). Combined, longer lives and lower savings are fueling a retirement security crisis for millions of American. Join us for an active discussion regarding what to expect as well as tools and solutions available to American’s retirees to help decrease longevity and healthcare cost risk. Speakers:

|

TUES, OCT 27

|

DC COMMUNITY EXCHANGE – optionalDC Community Exchanges are virtual small group (10 ppl) moderated discussion sessions that are open to all attendees every Tuesday in October. The DC Community Exchanges offer an opportunity to connect with your peers while discussing various topical questions. The exchange sessions are optional, and attendees may sign up on the event registration form. NAGDCA will reach out in late August/early September to confirm your participation. |

WED, OCT 28

|

LEARNING LABS – GROUP 2Auto Features: Set it and forget it? Automatic enrollment is one of the most effective ways to increase participation in workplace retirement plans. Yet according to NAGDCA research, half of the states wholly prohibit automatic enrollment for public employees, while another 16 limit it in some form. This panel will explore both sides of the issue. First, we will hear about the two-year journey one organization took to implement a new automatic enrollment program. In contrast, we will hear from a plan that was prohibited from using automatic enrollment but found alternative methods for increasing plan participation. So regardless of your state’s laws, there are methods and paths to improve your plan’s outcomes. Speakers:

Seeking the Holy Grail – Holistic Financial Wellness COVID-19 has put a magnifying glass on a huge problem: the financial fragility of the American workforce. Prior to the pandemic, half of Americans lived paycheck-to-paycheck, with many treating credit cards as an emergency savings option. Forty-one percent of Americans were unable to cover an unexpected $400 expense without borrowing money or selling a personal item. These staggering statistics demonstrate the struggle Americans face not only in saving for retirement, but in achieving financial stability in their daily lives. This panel will focus on the current state of financial wellness needs of government workers and the available programs to meet these needs: where they stood pre-COVID-19 and how they have been impacted since. Learn:

Speakers:

To catch a thief: Fraud and cybersecurity in a connected world Hacking, breaches, viruses, ransomware – cybersecurity is scary. But what action can you take as a plan sponsor to both prevent attacks and respond to them when they occur? Our panel of experts will discuss the latest tactics to keep the bad guys at bay that you can take back to the office and immediately implement to protect unauthorized access to your plan and your participants. Speakers:

|

THURS, OCT 29

|

P2P EXCHANGE – optional; plan sponsors onlyP2P Exchanges are virtual small group (10 ppl) peer-to-peer moderated discussion sessions that are only open to government attendees every Thursday in October. The exchange sessions are optional, and attendees may sign up on the event registration form. NAGDCA will reach out in late August/early September to confirm your participation. |

Speakers

Click below to learn about the Connect speakers and moderators.

Sponsors

Click here to learn about NAGDCA Connect sponsorship opportunities.

VISIONARY

PREMIER

PARTNER

SUPPORTER

Continuing Education

Please contact Carly Miller at cmiller@amrms.com if you have any continuing education questions.

National Association of Government Defined Contribution Administrators 108617 is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org.

National Association of Government Defined Contribution Administrators (NAGDCA) is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. The total number of PDCs for the SHRM-CPSM or SHRM-SCPSM for this program will be listed once approved (credits awarded based on session attendance). For more information about certification or recertification, please visit www.shrmcertification.org.

NAGDCA is also eligible to offer continuing education credits for CFP and CRC designations. For more information about the CFP program, please visit www.CFP.net, and for more information regarding the CRC program, please visit www.InFRE.org.

For the virtual NAGDCA Connect sessions, no advanced preparation nor prerequisites are required.