Download

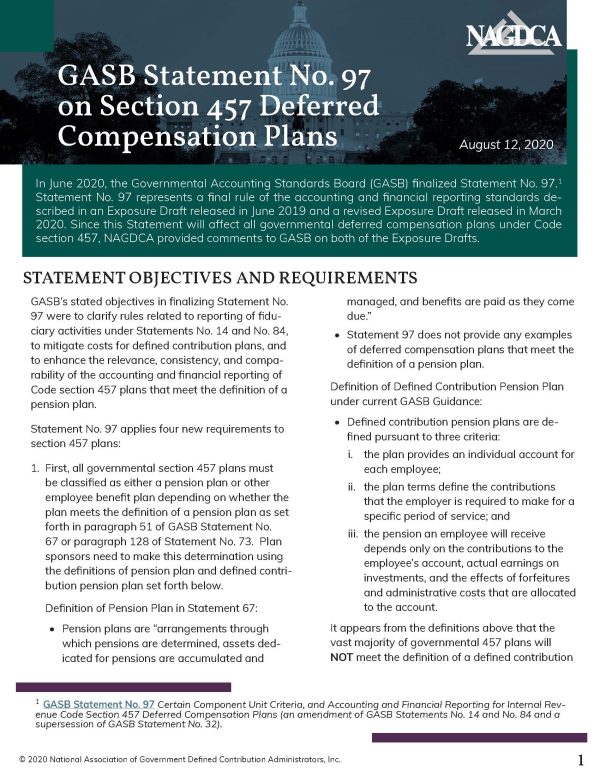

Recently, the Governmental Accounting Standards Board (GASB) announced Statement No. 97, Certain Component Unit Criteria, and Accounting and Financial Reporting for Internal Revenue Code Section 457 Deferred Compensation Plans.

The purpose of Statement No. 97 is to:

- clarify rules related to reporting of fiduciary activities under Statements No. 14 and No. 84;

- mitigate costs for defined contribution plans; and

- enhance the relevance, consistency, and comparability of the accounting and financial reporting of Code section 457 plans that meet the definition of a pension plan.

We’ve reviewed and evaluated Statement No. 97 to provide you with a summary of the relevant objectives, requirements, and guidance you need to be in compliance with this new standard. Click above to download the assessment.

- Version

- 0.00 KB File Size

- August 12, 2020 Create Date

- August 31, 2023 Last Updated