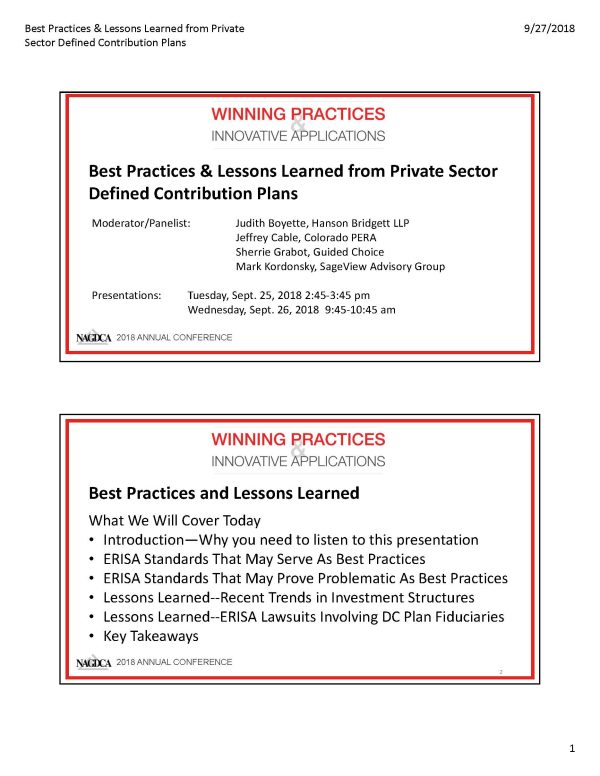

Although governmental defined contribution plans are not subject to the rules of the Employee Retirement Income Security Act of 1974 (ERISA), many such plans use ERISA rules as a best practice in various areas of plan administration, such as selection of investment options, fee disclosures, fiduciary responsibilities, and claims and appeals procedures.

The session will address the areas in which it may be a good idea to utilize ERISA standards as best practices, as well as areas in which following ERISA may not be in your plan’s best interest or even may be in conflict with your plan’s rules and regulations. In addition, the session will include a brief discussion of the recent lawsuits against ERISA defined contribution plan fiduciaries and how these lawsuits provide important lessons to governmental defined contribution plans.

- Version

- 0.00 KB File Size

- September 25, 2018 Create Date

- August 31, 2023 Last Updated