NAGDCA Virtual Annual Conference

NAGDCA’s Annual Conference is the nation’s premier event for public sector defined contribution administrators. While we are all disappointed we can’t be together in person this year, we’re grateful we can still connect virtually. The virtual conference will offer plan sponsors and industry representatives the opportunity to network with each other, share ideas with peers, learn innovative techniques for improving retirement outcomes, and much more!

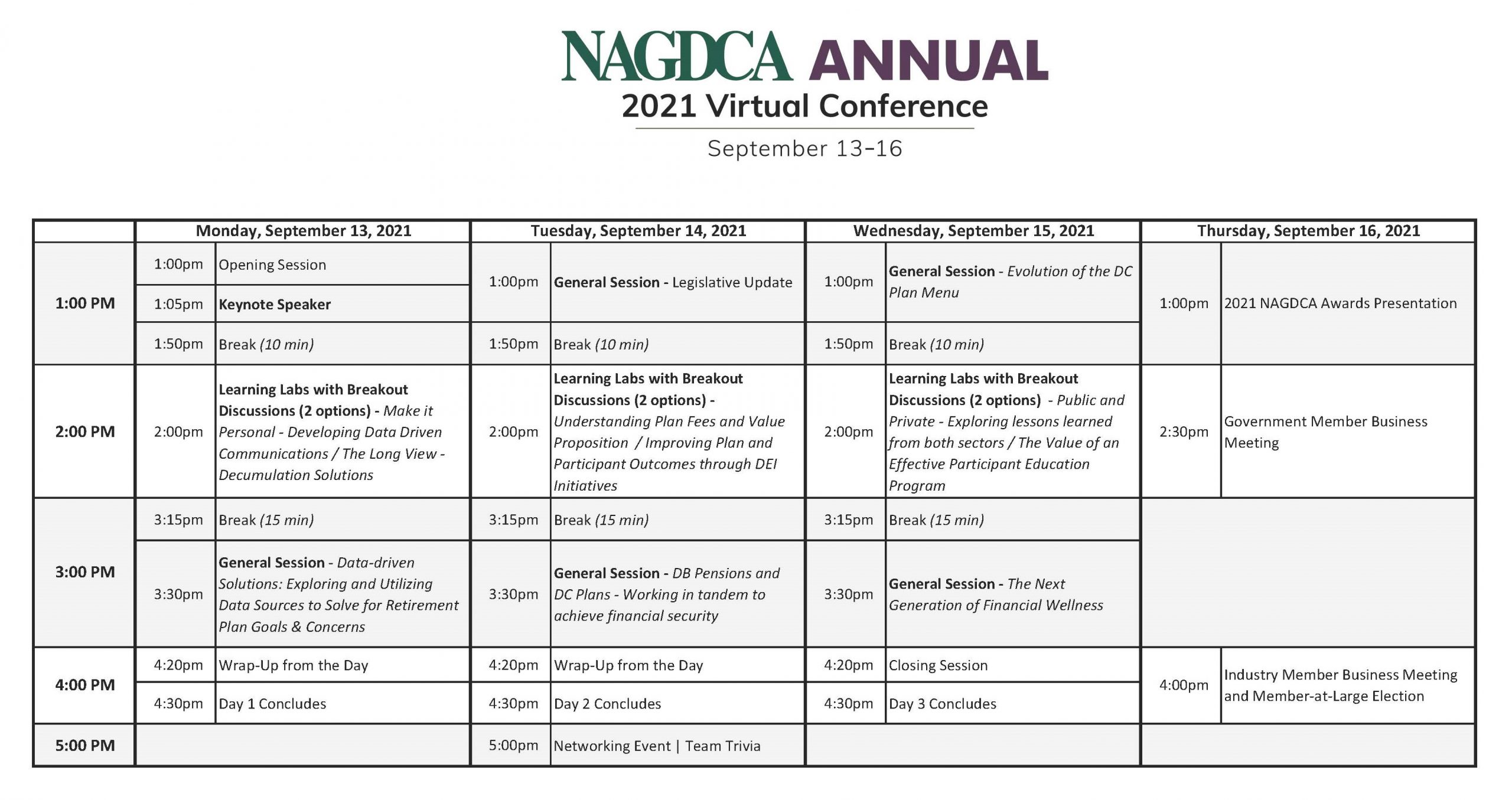

WHEN : Monday, September 13 – Thursday, September 16

WHERE : CLICK HERE to log in to the event platform.

Access Recordings

Session recordings are posted in the event platform and conference app and are currently only available to conference registrants.

To access recordings:

- Click here to log in to the event platform.

- Navigate to the session.

- Click “View Recording” found under “Session Resources.”

Registration Information

Registration includes access to all conference sessions and events during September 13-16, 2021 and access to all recordings after the conference ends.

| Member Type | Registration Fee |

|---|---|

| Government Member | $200.00 |

| Government Non-member¹ | $200.00 |

| Industry Member | $300.00 |

| Industry Non-member | $300.00 |

¹ Government Non-member registration includes complimentary NAGDCA membership beginning on the date of purchase through Dec. 31, 2021. Only available to plans who have not been members within the past three years.

Questions? Please email registration@nagdca.org if you have conference registration questions.

Day 1 | Monday, September 13

| 1:00 p.m. – 1:50 p.m. ET | CONFERENCE OPENING & KEYNOTE SPEAKER

Burning Shield – The Jason Schechterle Story Through a series of miraculous and fateful circumstances, Jason survived the crash and ensuing physical and emotional catastrophe. He suffered severe burns to over 40% of his body which drastically altered his appearance. He has undergone more than 50 surgeries just to have the ability to accomplish simple daily tasks we often take for granted. Jason’s journey chronicles his fight for life, his triumph over tragedy and the inspiration that enables him to continue to overcome unimaginable adversity. His personal narrative exemplifies that the power of the human spirit can never be underestimated or extinguished. |

| 1:50 p.m. – 2:00 p.m. ET | Break |

| 2:00 p.m. – 3:15 p.m. ET | LEARNING LABS WITH BREAKOUT DISCUSSIONS – (2 options)

Make it Personal – Developing data-driven communications Speakers:

The Long View – Decumulation Solutions Speakers: |

| 3:15 p.m. – 3:30 p.m. ET | Break |

| 3:30 p.m. – 4:20 p.m. ET | GENERAL SESSION

Data-driven Solutions: Exploring and Utilizing Data Sources to Solve for Retirement Plan Goals & Concerns Join three members of the Plan Sponsor Advisory Council for PRRL as they discuss their approach to data, the sources on which they rely for the data, and how they use it. The session will explore three levels of data: participant level, plan level, and peer group/outside data. Speakers: |

| 4:20 p.m. – 4:30 p.m. ET | DAY 1 WRAP UP |

Day 2 | Tuesday, September 14

| 1:00 p.m. – 1:50 p.m. ET | GENERAL SESSION

Legislative Update Join Groom Law Group attorneys for a discussion of current and future legislative and regulatory priorities in Washington. Speakers: |

| 1:50 p.m. – 2:00 p.m. ET | Break |

| 2:00 p.m. – 3:15 p.m. ET | LEARNING LABS WITH BREAKOUT DISCUSSIONS – (2 options)

Improving Plan and Participant Outcomes through DEI Initiatives This session will highlight best practices and initiatives in the public and private sector defined contribution plan industry to address historical inequities in retirement plan coverage, account balances and opportunity. The presentation will include a review of DC plan design, investment program and communications initiatives that support diversity, equity and inclusion goals. Speakers:

Understanding Plan Fees and Value Propositions Speakers: |

| 3:15 p.m. – 3:30 p.m. ET | Break |

| 3:30 p.m. – 4:20 p.m. ET | GENERAL SESSION

DB Pensions and DC Plans – Working in tandem to achieve financial security This session will explore how US retirement income sources have changed for both private and public sector workers and provide tactics for educating public sector employees about the importance of utilizing multiple sources of income to ensure financial security in retirement. Learn how to help employees understand the role of DC plans and how to communicate the benefits with employees, specifically the under 40 population who may be most likely to have lesser pension benefits than their older counterparts. Speakers: |

| 4:20 p.m. – 4:30 p.m. ET | DAY 2 WRAP UP |

| 5:00 p.m. – 6:00 p.m. ET | VIRTUAL NETWORKING EVENT | TEAM TRIVIA

Join your NAGDCA peers for a fun afternoon of networking and team trivia. Attendees will be placed into randomized teams, guided through 3 rounds of unique questions by TriviaHub quiz masters, and ultimately find out who the true trivia champions are! Sign up when you register. |

Day 3 | Wednesday, September 15

| 1:00 p.m. – 1:50 p.m. ET | GENERAL SESSION

Evolution of the DC Plan Menu This session will explore various investment options – active vs passive, ESG, managed accounts, stable value/fixed income solutions, in-plan guaranteed investment options, TDFs – and the pros and cons of each. Learn about strategies and communication techniques that plan sponsors can employ to enhance plan design and investments for participants, especially those near retirement. Speakers:

|

| 1:50 p.m. – 2:00 p.m. ET | Break |

| 2:00 p.m. – 3:15 p.m. ET | LEARNING LABS WITH BREAKOUT DISCUSSIONS – (2 options)

Public and Private – Exploring lessons learned from both sectors Speakers:

The Value of an Effective Participant Education Program Speakers:

|

| 3:15 p.m. – 3:30 p.m. ET | Break |

| 3:30 p.m. – 4:20 p.m. ET | GENERAL SESSION

The Next Generation of Financial Wellness This session will explore program components and communication approaches to help improve the financial well-being of employees and discuss the importance of data-sharing with recordkeepers to develop personalized programs. Learn about emerging trends and tools, and how comprehensive financial wellness programs benefit both participants and employers. Speakers:

|

| 4:20 p.m. – 4:30 p.m. ET | CLOSING SESSION |

Day 4 | Thursday, September 16

| 1:00 p.m. – 1:50 p.m. ET | 2021 NAGDCA AWARDS PRESENTATION

The annual NAGDCA Awards Program recognizes the brightest ideas and most innovative solutions from across the industry. Join us to learn about the 2021 Leadership Award Winners and for the presentation of the prestigious NAGDCA Art Caple President’s Award. Don’t miss this opportunity to celebrate your colleagues and learn from their outstanding achievements. Click here to register for the awards presentation. |

| 2:30 p.m. – 3:15 p.m. ET | ANNUAL GOVERNMENT MEMBER BUSINESS MEETING

Government members only. Click here to register for the meeting. |

| 4:00 p.m. – 4:45 p.m. ET | ANNUAL INDUSTRY MEMBER BUSINESS MEETING AND MEMBER-AT-LARGE ELECTION

Industry members only. Click here to register for the meeting. |

Speakers

Click below to learn about the #NAGDCA21 speakers and moderators.

Sponsors

Click here to learn about NAGDCA sponsorship opportunities.

Visionary Sponsors

Premier Sponsors

Partner Sponsors

Supporter Sponsors

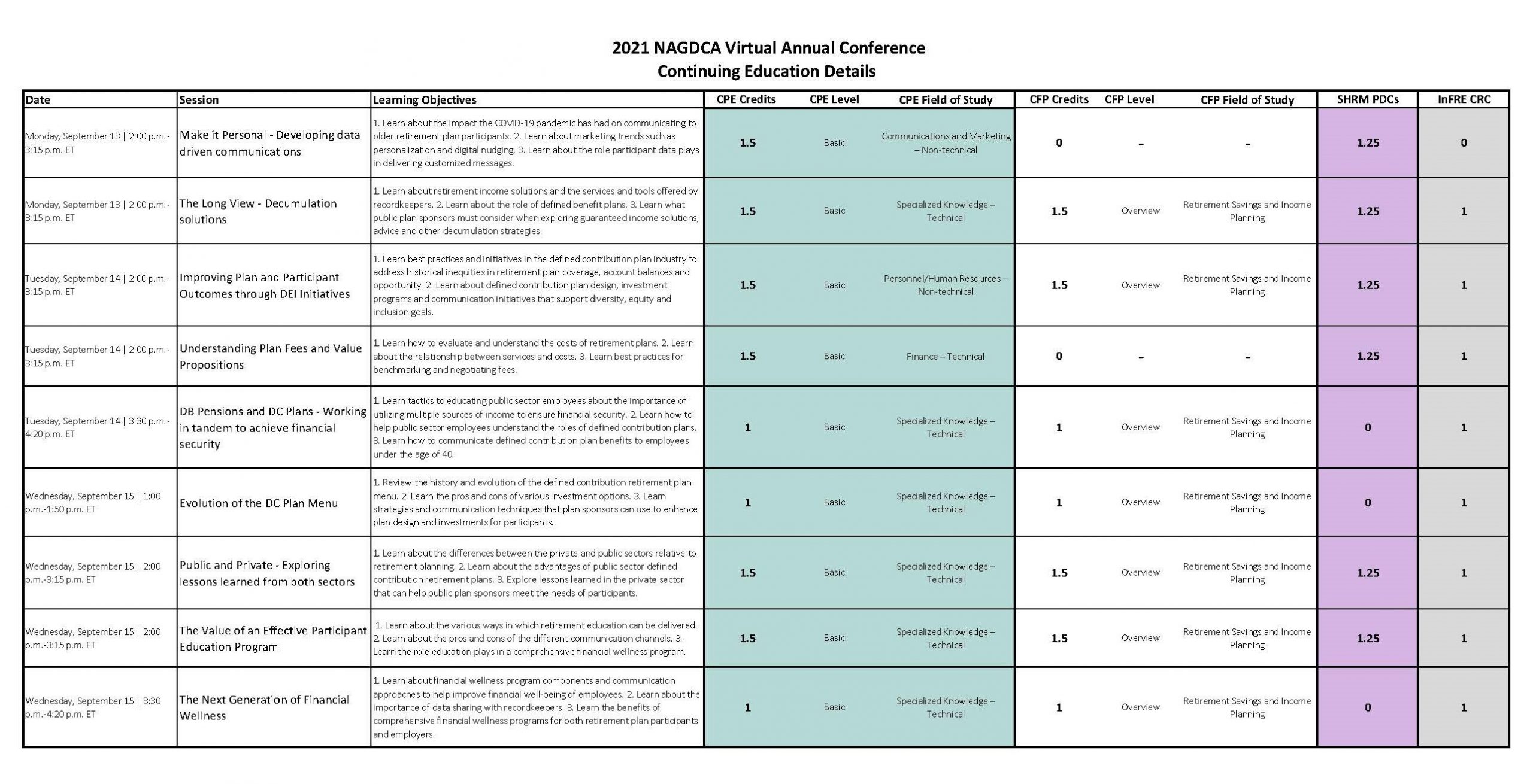

Continuing Education

For the virtual NAGDCA Annual Conference sessions, no advanced preparation nor prerequisites are required. The delivery method for all sessions is Group Internet Based.

Please contact Carly Miller at cmiller@amrms.com if you have any continuing education questions.

The National Association of Government Defined Contribution Administrators, Inc (NAGDCA) is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State Boards of Accountancy have the final authority on the acceptance of individual course for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.

The National Association of Government Defined Contribution Administrators, Inc (NAGDCA) is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State Boards of Accountancy have the final authority on the acceptance of individual course for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.

National Association of Government Defined Contribution Administrators (NAGDCA) is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. The total number of PDCs for the SHRM-CPSM or SHRM-SCPSM for this program will be listed once approved (credits awarded based on session attendance). For more information about certification or recertification, please visit www.shrmcertification.org.

National Association of Government Defined Contribution Administrators (NAGDCA) is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. The total number of PDCs for the SHRM-CPSM or SHRM-SCPSM for this program will be listed once approved (credits awarded based on session attendance). For more information about certification or recertification, please visit www.shrmcertification.org.

NAGDCA is also eligible to offer continuing education credits for CFP and CRC designations. For more information about the CFP program, please visit www.CFP.net, and for more information regarding the CRC program, please visit www.InFRE.org.