Speaker Bios

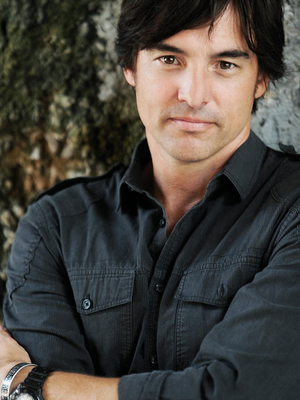

KEYNOTE SPEAKER:

In the summer of 1993 Staff Sergeant Keni Thomas was deployed to Mogadishu Somalia with the 3rd Ranger Battalion as part of an elite special operations package called Task Force Ranger. Their mission was to find and capture a criminal warlord named Mohammed Farrah Aidid. On the 3rd of October, Keni and his fellow rangers distinguished themselves in an eighteen hour fire-fight that would later be recounted in the highly successful book and movie “Black Hawk Down”. Nineteen Americans gave their lives and 78 were wounded in the worst urban combat seen by US troops since WWII.

A powerful speaker, Keni captivates audiences from beginning to end as he tells the incredible story of extraordinary individuals and how they fought to bring each other home. Drawing from his experiences on the battlefield, Keni inspires people to achieve greatness by stressing the importance of outstanding leadership at every level, even if the only person you are leading is yourself. His message of “Train as You Fight, Fight as You train and Lead By Example” for epitomizes the Ranger motto “Rangers Lead the Way!”

Keni sums it up like this, “Leadership has never been the rank, the position or the title you hold. It’s the example you set for the ones you serve. And we all serve somebody. There are people to your left and to your right who are counting on you and it’s up to you to deliver. But you will only be as good as you prepared yourself to be.”

After Mogadishu, Staff Sergeant Thomas volunteered for one more enlistment in the Army. He became an assistant team leader for a six-man ranger reconnaissance team. He earned his master parachutist rating with over 400 military free fall jumps. He completed the Special Forces Combat Diver course, became an Advanced EMT and was one of ten Americans to complete the Belgium Commando Course.

Keni got out of the Army to pursue his music career and became an award-winning country music recording artist and songwriter in Nashville. He and his band Cornbread were featured in the movie “Sweet Home Alabama” and his music can be heard on country stations nationwide. Keni continued to serve our troops with regular tours to Iraq and Afghanistan.

Keni Thomas is a best selling author, an Emmy-winning producer and a regular guest on all the major news networks as a military analyst. Keni also got to be a military advisor for the Mel Gibson movie “We Were Soldiers”. He has been recognized by the President of the United States, by Congress and has been awarded the American Patriot Award for his dedicated work on behalf of our veterans and their families.

Keni is most proud of his appointment as a national spokesman for the Special Operations Warrior Foundation. They provide college educations to the children of our special operations personnel killed in combat or training.

“Our special operations warriors are the tip of the spear. Their’s is a dangerous and high risk mission” says Thomas. “Because of that, their losses are disproportionately high when compared to the rest of our military. Taking care of their kids, is the least we can do. It’s what those dads would have wanted.”

Keni is a graduate of the University of Florida and a recipient of the bronze star for valor.

SESSION SPEAKERS & MODERATORS:

Jennifer Archer, Head of Institutional Defined Contribution Sales

Jennifer Archer, Head of Institutional Defined Contribution Sales

JP Morgan

Jennifer M. Archer, Managing Director, is Head of Sales, North Americas Institutional – Defined Contribution for J.P.Morgan Asset Management. Jennifer focuses on business development and serving the investment and communications needs of corporate and public defined contribution plans with the goal of improving participant retirement outcomes. An employee since 2011, Jennifer was previously a product director with AllianceBernstein where she was responsible for the development and support of their defined contribution investment solutions for both plan sponsors and intermediaries. Before joining AllianceBernstein, she was in the Investment Solutions group at UBS. She received a B.S. in business from James Madison University. Jennifer holds FINRA Series 3, 7 and 63 licenses and is a Chartered Retirement Planning Counselor (CRPC).

Rob Austin, Head of Research

Rob Austin, Head of Research

Alight Solutions

Rob Austin is the Head of Research at Alight Solutions. In this role, Rob examines participant behavior across the healthcare and retirement landscape to bring data and insights to clients to help them improve their benefit plans and communication materials. Rob first began working in the industry in 1998 as a pension actuary and retirement consultant. He is particularly focused on behavioral finance issues as they relate to benefit plans. Rob is considered a leading expert on retirement issues and often appears in top media outlets including Wall Street Journal, NPR, Bloomberg, Forbes, US News and World Report, CNN Money, USA Today, ABC News, CBS News, Yahoo Finance, Pensions and Investments, and CNBC. He is also a frequent speaker at industry events and conferences and sits on the Executive Board of the Defined Contribution Institutional Investor Association (DCIIA).

Gay Lynn Bath, Director of Retirement

Gay Lynn Bath, Director of Retirement

Oregon Public Universities Retirement Plans

Gay Lynn Bath has been the Director of Retirement Plans Management at the University of Oregon since 2015. In that capacity, she is responsible for the administration of 401(a) and 403(b) retirement plans for 7 Oregon universities. The overall assets of the plans are more than $2 billion with over 18,000 participants. Prior to this position, Bath was the Plan Administrator for the Oregon Savings Growth Plan (OSGP), a 457(b) plan for 11 years. Bath received her Bachelor’s degree in Business from Regis University in Denver, and her Masters of Business Administration degree from Northwest Nazarene University in Nampa, Idaho. She previously served as an executive board member and past-president for the NAGDCA. She has been a moderator and panelist at several conferences covering many different defined contribution topics.

Ronda Butler Bell, Executive Director and Board Secretary

Ronda Butler Bell, Executive Director and Board Secretary

Maryland Teachers & State Employees Supplemental Retirement Plans

The MSRP Board of Trustees appointed Ronda Butler Bell as Executive Director & Board Secretary in January 2021. Ms. Bell is responsible for the policy, direction, and operations of MSRP as well as general oversight of the Plan Administrator, Investment Advisor, and Stable Value Fund Manager. She earned a Bachelor of Science degree in Law/Legal Studies (magna cum laude) from the University of Maryland University College and a Master of Public Administration in Public Policy and Administration (magna cum laude) from the University of Baltimore College of Public Affairs.

Allison Brodine, Total Rewards Manager

Allison Brodine, Total Rewards Manager

Public Utility District #1 of Chelan County

Allison has served 14 years in HR Leadership roles with Chelan County Public Utility District, a hydropower producer located in central WA state. She currently manages compensation and benefits and is a fiduciary for the District’s 457b and 401(a) plans.

Kim Burch-Garcia, Principal Analyst

Kim Burch-Garcia, Principal Analyst

County of Los Angeles

Kimberly Burch-Garcia serves as the Principal Analyst for the County of Los Angeles’ Defined Contribution Program (DCP). The County’s DCP consists of three plans, the 457(b) Horizons, the 401(k) Savings and a Pension Savings Plan. The County’s DCP has more than 115,000 participants with approximately $20 billion in assets.

Kimberly’s role is general overall administration of the DCP which includes plan design and developing policy. She also makes complex administrative correction decisions, ensures record keeping management complies with IRS regulations, County Code and adheres to the Third-Party Administration contract. Kimberly also develops Request for Proposal materials, develops and monitors the Plans administrative budget, creates marketing materials and serves as the Plans Filing Officer.

Jay Castellano, Employee Benefits – HR

Jay Castellano, Employee Benefits – HR

County of San Mateo

Mr. Castellano is the former benefits manager for the City of San Jose. He also managed employee benefits on an interim basis for the County of San Mateo and the City of San Mateo. In San Jose, Mr. Castellano managed all aspects of the welfare benefits program (14,000 lives) plus the defined contribution retirement program (currently $1.4 billion in assets). He managed a similar scope of programs in San Mateo County (14,000 lives and $700 million in assets). In the City of San Mateo, Mr. Castellano consulted in implementing the Affordable Care Act employer requirements and in updating the deferred compensation plan’s governance structure and operations.

In “retirement”, Mr. Castellano continues to work part-time with the County of San Mateo, is current president of the San Jose Retired Employees Association, was chair of the City of San Jose’s defined benefit retirement board, and volunteered for the International Foundation of Employee Benefit Plans as both an instructor and as a member of the Trustees Committee.

Jeff Cimini, SVP, Retirement Product Management

Jeff Cimini, SVP, Retirement Product Management

Voya Financial

Jeffrey Cimini is senior vice president of Retirement Product Management for Voya Financial. In his role, Jeff oversees the team responsible for all aspects of the centralized retirement product functions, including product management, development, strategy, pricing, competitive intelligence, Voya Institutional Trust Company and the advisory services programs that Voya offers to plan sponsors and their participants. Jeff has more than 30 years experience in the financial services industry.

Beth Conradson Cleary, Executive Director

Beth Conradson Cleary, Executive Director

City of Milwaukee

Ms. Cleary has served as the Executive Director of the City of Milwaukee’s nearly $1 billion 457(b) Deferred Compensation Retirement Plan since 2017, following a six-month term as the Plan’s interim ED. Previously, she served for five years as the Deputy Director of the City of Milwaukee $5+ billion pension fund, the Employees’ Retirement System (ERS)—one of three public pension systems in the state of Wisconsin. Prior to that, Ms. Cleary was an Assistant City Attorney for Milwaukee, where she served as general counsel to the ERS for over five years.

Ms. Cleary earned her BA from Creighton University; her MA in Bioethics from the Medical College of WI; and her JD and Graduate Certificate in Dispute Resolution from Marquette University Law School, where she served as Editor in Chief of the Marquette Elder’s Advisor Law Journal.

Amelia Dunlap, VP, Marketing

Amelia Dunlap, VP, Marketing

Nationwide

Amelia has over 15 years of experience in the financial services and insurance industry. She started her career at Weber Associates, a boutique consulting firm / marketing agency, where she was evolved from analyst, to project manager, to relationship manager to business development lead for many significant brands. The relationships she supported included: Nationwide Financial, Nationwide Insurance, MetLife, Prudential, The Hartford, Great-West Retirement Services, and JP Morgan.

After a decade in consulting, Amelia moved to Prudential Financial where she was a leader with the Customer Experience organization for the Life Insurance and Annuities businesses (Individual Solutions Group). During her time at Prudential she was responsible for the development of testing platforms including SimplyTerm and Guaranteed Income for Tomorrow (GIFT), which were both pioneering efforts for the digital, direct-to-consumer space.

Amelia joined Nationwide in 2020, where she leads the Marketing organization which is responsible for using data to communicate across all audiences (Intermediaries, Plans and Plan Participants) to help participants both plan for and live-in retirement.

Marina Edwards, Senior Defined Contribution Strategist

Marina Edwards, Senior Defined Contribution Strategist

Invesco

Marina Edwards is a Senior Defined Contribution Strategist for the North America Institutional Sales team at Invesco. In this role, she specializes in fiduciary risk mitigation strategies for plan sponsors and is a regular speaker at DC industry events.

Christina Elliott, Executive Director

Christina Elliott, Executive Director

Ohio Deferred Compensation

Christina Elliott serves as the Executive Director for the Ohio DC. In this role, Ms. Elliott oversees the $19.5B 457(b) retirement plan, which is a public, non-profit organization created by Ohio statutes. She reports to a 13-member Board, composed of public employees, retirees, and appointed investment experts that govern the Program. Christina has 15 years of investment and finance experience and is passionate about her role in the community. She currently lives in Dublin, Ohio with her husband of 11 years, Travis, and their adorable daughters, Adelyn, 9, and Harper, 7. The family just adopted Milo, an English Cream Golden Retriever.

Naomi Fink, Retirement Economist

Naomi Fink, Retirement Economist

Capital Group | American Funds

Naomi Fink is a retirement economist within Capital’s Institutional Analytics Group, focusing on institutional retirement. Naomi has 24 years of financial industry experience and has been with Capital Group for five years, which she has spent conducting research on retirement-related topics, including savings, investment, income, demographics and health. Before joining Capital in 2016, Naomi founded Europacifica Consulting, a global economics and strategy consulting firm. Prior to founding Europacifica, Naomi held the position of chief Japan strategist and Senior Vice President at Jefferies Japan Limited. Before that, she held chief strategist roles across a variety of markets and asset classes at global banks, including Bank of Tokyo Mitsubishi UFJ and BNP Paribas. Naomi holds an MSc in Specialized Economic Analysis (Macroeconomic Policy and Financial Markets) from Barcelona GSE, an M.A. Honours from the University of St. Andrews, and was nominated to the Japan Society of Monetary Economics in 2014.

Joshua Franzel, Managing Director of MissionSquare Research Institute

Joshua Franzel, Managing Director of MissionSquare Research Institute

MissionSquare Retirement

Dr. Franzel is the Managing Director of MissionSquare Research Institute, formerly the Center for State and Local Government Excellence at ICMA-RC (SLGE), having served in other positions with SLGE since 2007. In this role, he oversees all aspects of the Institutes’ research and outreach, stakeholder engagement, and operations. He also serves as research project director, subject matter and research methods expert, and principal investigator, while representing the Institute at practitioner and academic events and to the trade and mainstream media.

Previously he was director of policy research for the International City/County Management Association (ICMA). Prior to his time with SLGE and ICMA, he served as a Presidential Management Fellow with The International Trade Administration and The White House Office of Management and Budget, and worked for both the Delaware and Florida Legislatures.

His publications and research have focused on state and local government retirement plans, financial wellness, public workforce demographics, health care financing, public health, public finance, infrastructure, and government innovation. Franzel has taught graduate level courses on state and local government and urban policy at American University in Washington, DC. He holds a Ph.D. in Public Administration (& Policy) from American University.

Vince Garzarella, Head of Mid-Large Markets, Retirement Plan Services

Vince Garzarella, Head of Mid-Large Markets, Retirement Plan Services

Lincoln Financial Group

Vincent Garzarella is Head of Mid-Large Markets. In this role, Vince develops and executes a strategy focused on growing the Retirement Plan Services business in mid-large markets and delivering our high-touch model to more plan sponsors in these target markets. Vince works to ensure we have the right solutions in place to meet the needs of plan sponsors and continue to drive positive outcomes for participants across our target markets.

Prior to joining Lincoln, Vince spent 18 years at Vanguard, where he served in a variety of roles with increasing responsibility. He is a graduate of Villanova University, where he earned a Bachelor of Arts in Sociology and of Saint Joseph’s University, where he earned a Master of Business Administration. Vince is based in Radnor, Pennsylvania.

Sara Girgis, Benefits Manager

Sara Girgis, Benefits Manager

City of Anaheim

Sara Girgis has proudly been a public servant since the age of 16, working her way up to her current role as the Employee Benefits Manager at the City of Anaheim where she leads an exceptional team of human resources professionals. The City of Anaheim’s Human Resources team partners with City departments to hire, compensate, support and create a workforce dedicated to delivering high-quality services, which makes Anaheim a special place to live, work and play. Prior to joining the City of Anaheim in 2020, Sara spent 10 years at the County of San Bernardino, helping to expand Employee Benefits and Wellness programs for over 22,000 employees. As a seasoned Human Resources professional, Sara is passionate about Employee Benefits, financial & holistic wellness, and team building. Sara earned her Bachelors and Master’s degree in Business Administration with a focus on Management from California Baptist University. Outside of the office, Sara enjoys spending time and traveling with her biggest supporter and loving husband Ed, as well as going on hikes with their fur-baby, Teddy Bear.

Iasmina Giurgiev, Benefits Analyst

City of Vancouver, WA

Bio coming soon!

Danielle Gladstone, Head of Participant Engagement

State Street Global Advisors

Danielle is a vice president of State Street Global Advisors and the Head of Participant Engagement within the defined contribution team. In this role, she’s responsible for helping to drive State Street’s defined contribution initiative by providing high value thought leadership as well as differentiated communication and financial education tactics to retirement plan sponsors.

Danielle specializes in understanding investor behavior, gender gaps, education, financial literacy and wellness as it relates to retirement planning. She’s been in the investment industry since 2005, having held previous positions at BNY Mellon and Fidelity Investments.

Danielle holds a B.A. in English, Communications and Media from Emmanuel College.

Charles Griffin, IT Security Consultant

Charles Griffin, IT Security Consultant

Voya Financial

Charles has over 21 years of experience in cybersecurity. He has had a unique background working for security device manufacturers, engineering solutions as a value-added-reseller and customer as the first ISO at Quinnipiac University. Charles works closely with the Voya Cyber Security Teams. He represents the Technology Risk Security Management area and works with the Sales and Marketing Teams to present Voya’s cybersecurity stance to prospective and existing customers. He is also a security liaison addressing specific cyber security questions pertaining to RFP’s/RFI’s and other client inquiries.

Kelly Hiers, Defined Contribution (DC) Plans Administrator

Kelly Hiers, Defined Contribution (DC) Plans Administrator

Virginia Retirement System

Kelly Hiers serves as the Defined Contribution (DC) Plans Administrator for the Virginia Retirement System (VRS). She is responsible for the administration of VRS’ eight DC plans with assets of approximately $6.7 billion and more than 280,000 participants, serving more than 800 public employers. Kelly is responsible for plan oversight and compliance and works closely with internal staff and third-party administrators to develop participant and employer education and communication.

Kelly has worked in benefits administration for 22 years, focusing on DC plans for the last 18. Her administration expertise covers industry, plan sponsor and human resources/payroll experience, primarily with public-sector plans. She is an active member of the National Association of Governmental Defined Contribution Administrators and currently serves as a Secretary-Treasurer on their executive board. She is also a member of the International Foundation of Employee Benefit Plans and the Institute for Retirement Education (InFRE).

Barbara Healy, Consultant

Barbara Healy, Consultant

NFP Retirement

Barbara Healy is a SEC Registered Investment Advisor and Consultant affiliated with NFP Retirement/SST Benefits Consulting. Barbara advises public sector and non-profit educational institutions retirement plans nationwide. Prior to joining NFP Retirement/SST Benefits, Barbara was a Retirement Specialist at CUNA Mutual Group and also the Western Market District Regional Vice President. Barbara served as a Vice President at Great West Life & Annuity (Empower) in charge nationally of the education retirement market. She was responsible for the successful launch of an innovative, low-cost open architecture, internet-based IRC §403(b) and IRC §457(b) plan offering. Barbara was recruited by Great West from her Vice President of Business Development for all Public-Sector plans at Nationwide Retirement Solutions position where she worked for two years with the NEA ValueBuilder program among many other responsibilities.

Barbara was responsible for MetLife’s K-12 Education retirement market nationally prior to Nationwide. Barbara started her career as a high school business teacher at a Chicago high school. She earned an MBA and entered the Financial Services Sector as the first Director of Membership Services and Certified Financial Planner for the San Diego Teachers Association.

She has 35+ years of experience exclusively assisting public sector plans, school districts, credit unions and other non-profits with their retirement and pension plans. Barbara has earned an MBA degree in finance from DePaul University. She earned the CFP® designation from the College of Financial Planning, the Certified Funds Specialist designation, the Chartered Mutual Fund Specialist designation, the Certified Retirement Administrator designation, and the ASPPA TGPC designation and the AIF designations. Barbara is a member of the Institute of Business and Finance, Who’s Who in Financial Planning, National Association of Government Defined Contribution Administrators (NAGDCA), Madison’s Who’s Who, and the Gerson Lehrman Consulting Group.

She has volunteered her time for NAGDCA and InFRE. Barbara is popular lecturer and has authored the book “Personal Financial Planning Handbook for Education and other Nonprofit Employees” and has published many financial articles and monographs as well as recorded many educational recordings for MetLife Resources, Nationwide Retirement Solutions, and Great West Life. She has been an adjunct lecturer for marketing and finance courses at several Community Colleges. Recently, Barbara was appointed to serve on the CFP® Council on Education.

Barbara also served on the Arizona Town Hall and the Arizona School to Work Partnership Boards for several years.

Jeff Hutson, Principal Consultant

Jeff Hutson, Principal Consultant

Relational Gravity, LLC

Jeff Hutson is the founder and principal consultant for Relational Gravity. He focuses on applied retirement research to help plans make a meaningful and measurable difference to their participants. For more than 15 years, he led participant communication, education, and research for the Indiana Public Retirement System’s five defined contribution and eight defined benefit plans. He holds a Certified Retirement Counselor (CRC) certification through the International Foundation for Retirement Education (InFRE). In addition, he is accredited by the International Association of Business Communicators (IABC) and holds an Insights Professional Certification (IPC) through the Insights Association, the nation’s leading professional organization for market research and data analytics. Jeff holds a bachelor’s degree in journalism focusing on economics from Butler University’s Lacy School of Business, a master’s degree in public relations focusing on integrated marketing communication from Ball State University, and a certificate in market research from the University of Georgia.

Bryan Jeffries, President

Bryan Jeffries, President

Professional Fire Fighters of Arizona

Bryan is the Chair for the City of Mesa Fire 457/401a plan, a trustee for the Arizona Public Safety Retirement System DC Plan, President of the AZ Professional Firefighters Association, and a longtime attendee of NAGDCA.

Greg Jenkins

Greg Jenkins, Head of Institutional DC

Invesco

Greg Jenkins is a Managing Director and Head of Institutional Defined Contribution on the North American Institutional team. As a managing director, he and his team are responsible for new business development and relationship management with plan sponsors and consultants. In addition to his role at Invesco, Jenkins serves on committees with the Defined Contribution Institutional Investment Association, the National Association of Government Defined Contribution Administrators, Inc. and the Defined Contribution Real Estate Council. He is a frequent speaker and thought leader on relevant topics in the retirement industry.

Zach Karas, Principal

Retirement Plan Advisors

Zach began his career with a leading public sector plan provider in 1984 and spent over 24 years in their retirement plans practice. He began as an Account Representative, conducting field enrollment and administering 457, 401(a), 403(b), and 401(k) plans throughout New England and New York. He then transitioned to Senior Account Representative, marketing group retirement plans, managing staff representatives and independent brokers, and working extensively with plan sponsors on the design and ongoing administration of their defined contribution plans.

Zach advanced to Regional Manager and expanded the firm’s market presence throughout the Midwest. He also managed and grew the group retirement plan markets throughout New England and New York while supervising the internal staff and field personnel.

Promoted to Regional Vice President, Zach led the sales, management, and distribution of defined contribution plans in the governmental, not-for-profit, and tax-exempt marketplace. Recognized as an industry leader, in 2006 he was named Vice President, National Director of Government Sales. In this role, he provided leadership and direction for the distribution of defined contribution plans in the government marketplace, where he developed strategic plans for the business line. Zach managed an internal distribution team as well as the broker/advisor distribution of governmental defined contribution plans nationwide.

A graduate of Connecticut College (CT), Zach earned a Bachelor of Arts degree in Economics. He holds FINRA Series 6, 63, 65 (Investment Advisor Representative), and 26 (Registered Principal) registrations, and is licensed to offer life, health and accident, and variable contracts insurance.

Michael Kreps, Principal, Co-Chair Retirement Services Practice

Groom Law Group

Michael Kreps specializes in issues relating to public policy, fiduciary responsibility, and plan funding and restructuring. He routinely represents both private and public sector clients before federal agencies and Congress.

Previously, Michael served as the Senior Pensions and Employment Counsel for the U.S. Senate Committee on Health, Education, Labor, and Pensions from the 110th through the 114th Congresses. In that role, he managed all aspects of the Committee’s retirement agenda and had primary staff responsibility for pension legislation, including the pension investment provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act, the funding stabilization and Pension Benefit Guaranty Corporation reform provisions of the MAP-21 Act of 2012, the Pension Relief Act of 2010, and the CSEC Pension Flexibility Act. He also led the Committee’s oversight of regulatory activities involving employee benefit plans.

Michael writes and speaks frequently on retirement and health policy.

John Lambertus, Strategic Research and Performance Manager

John Lambertus, Strategic Research and Performance Manager

Indiana Public Retirement System

John Lambertus is the Strategic Research and Performance Manager for the Indiana Public Retirement System. In this role, he manages the organizations’ voice of customer research efforts regarding members, employers and stakeholders. The role is charged with leading the development of a consistent, robust voice of the customer information system to support organization decisions. Deliver end to end consultation on voice of the customer findings and follow through on findings. He also works with the organization to identify key operating metrics necessary to deliver top member and employer experience.

Debby Larsen, Program Manager

Debby Larsen, Program Manager

State of Oregon

Debby joined Oregon Savings Growth Plan (OSGP) in August 2021 as the plan manager for the deferred compensation plan. Ms. Larsen holds a Bachelor of Arts degree in Management & Organizational Leadership from George Fox University. She’s been with Oregon State’s Public Employees Retirement System (PERS) for 12 years transferring to the OSGP team in 2021 and is responsible for the daily administration of the deferred compensation plan.

Prior to joining PERS in 2010, Debby worked for the Confederated Tribes of Grand Ronde Oregon for 17 years. Her experience there included managing the self-insured health plan for the tribal members and employees as the Financial Risk Manager. As such, she was specifically responsible for the management of a large multi-state (41 states) and 4 foreign countries health care plans. She also sat on the Tribes 401k Board of Trustees.

David Levine, Principal, Co-Chair Plan Sponsor Practice

Groom Law Group

David Levine is co-chair of the firm’s employer-focused practice. He advises plan sponsors, advisors, and other service providers on a wide range of employee benefits matters, from retirement and executive compensation to health and welfare plan matters.

David advises on the design and redesign of complex retirement, executive, and health and welfare plans; ongoing, day-to-day counseling of plan sponsors; in-depth compliance reviews of corporate and governmental benefit programs; products and compliance for retirement and health service providers, and representation of tax-exempt organizations with respect to issues involving corporate governance, executive compensation, and unrelated business income tax liability.

David was previously the Chair of the IRS Advisory Committee on Tax Exempt and Government Entities (2011-2013) and is currently a member of the Executive Committee of the Defined Contribution Institutional Investment Association and serves in a number of leadership roles in the American Bar Association Tax Section’s Employee Benefits Committee. Mr. Levine regularly speaks on plan design, fiduciary governance, and legislative issues and contributes a recurring column to NAPA Net — The Magazine. He is recognized in the Chambers USA guide for Employee Benefits & Executive Compensation.

Hank Levy, Treasurer

Hank Levy, Treasurer

Alameda County

Henry C. Levy (Hank) was appointed by the Board of Supervisors to fill the remaining term of the former Treasurer-Tax Collector (TTC) in May 2017 and was elected to a full four-year term in June 2018.

The job of the Alameda County TTC is varied:

-

-

-

-

-

- Tax Collection of Various Property Taxes in the county, plus business, utility, and hotel taxes in the unincorporated areas of the county; includes selling tax delinquent properties.

- Bank and Invest the County’s and School Districts’ excess funds, currently approximately $6 Billion.

- Direct the County’s elective supplemental deferred compensation program for County employees

- Ex-officio trustee on the Alameda County Retirement System (ACERA), which has responsibility for providing pension and other post-employment benefits to County retirees.

- Member of the Alameda County Finance Committee, which oversees bond issuance and other county financial matters.

-

-

-

-

Prior to becoming Alameda County, TTC, Hank managed his accounting firm, The Henry Levy Group, CPAs and Consultants, which he founded in 1991. He grew it to over 30 people in 6 offices in Northern California. He sold the firm in 2016 prior to his appointment as TTC.

Hank is currently on the board of two non-profits: Pogo Park (Richmond, CA) and Senior Medi-Benefits. He has served on numerous other non-profit boards and been active in government citizen organizations since the mid-1980’s. He served on the Alameda County Assessment Appeals board from 2004 to 2017. He taught income tax for the VITA (Volunteer Income Tax Assistance) program for 4 years.

An East Coaster by birth, Hank came out to California in his early twenties, living always on the border of Oakland and Berkeley. He raised 4 children, who attended Oakland and Berkeley public schools. Hank has been a baseball umpire for almost 20 years, and has written a short memoir on this subject. Hank was married to Marcia Goodman for almost 32 years until she passed away from complications from Ovarian Cancer on December 5, 2017.

Hank is an accredited community college instructor. He has taught accounting, employee benefits, and economics various Universities and colleges in the Bay Area.

Hank received his B.A (History) from Swarthmore College in Pennsylvania, his M.A (Industrial Arts) from San Jose State University, and his accounting education from California State University, Hayward (now Cal East Bay) and Golden Gate University.

Stephanie Linker, Head of Retirement Marketing

Stephanie Linker, Head of Retirement Marketing

BlackRock

Stephanie Linker, Director, leads Marketing for Retirement at BlackRock, where we are building a better retirement for all. Her team is responsible for participant engagement along with the full breadth of Marketing functions for defined contribution and retirement insurance including digital, content, paid media, partnership marketing, product marketing and events.

Prior to this role Stephanie spent three years in Hong Kong as the Head of Digital for Asia Pacific, where her team was responsible for product management, design, growth marketing, digital content strategy and marketing capabilities. She has been a driving force in BlackRock’s digital transformation initiative, partnering across teams and regions to define the digital strategy, introduce agile development and implement design thinking processes.

During her time at BlackRock Stephanie has also built a team focused on global mobile strategy and event technology, been the product owner for an industry leading retirement tool, worked as a digital strategist for the retail business, and served as the lead for two major website redesigns for both advisors and investors.

Stephanie earned a Bachelor of Science degree in Marketing from Lehigh University, graduating Phi Beta Kappa with highest honors.

Jared Martin, Consultant

Jared Martin, Consultant

Innovest Portfolio Solutions

Jared is a Principal and Consultant at Innovest Portfolio Solutions. At Innovest, Jared provides consulting services to Both Defined Contribution and Defined Benefit committees, boards, and individuals. He also manages the relationships between service providers and plan sponsors and provides ongoing vendor management for Innovest’s clients. He also leads many special projects for our retirement plan clients. Jared is also a member of the NexGen Society. Members of the NexGen Society are dedicated to leadership and instilling the Innovest culture into future generations.

Jared is a Certified Financial Planner®. Jared also holds an Accredited Investment Fiduciary (AIF®) designation. Jared received his bachelor’s degree in business and economics from Regis University in Denver.

Prior to joining Innovest, Jared was director of relationship management with ICMA-RC. Prior to being a relationship manager, he was financial planning manager with ICMA-RC for the previous 8 years. Jared is on the Board of the Colorado Public Plan Coalition (CPPC).

Dan Morrison, Senior Vice President, Head of Government Markets

Dan Morrison, Senior Vice President, Head of Government Markets

Empower

Dan is Senior Vice President of Government and Taft-Hartley Markets for Empower. With close to 25 years experience in the retirement plan industry, he oversees sales and client retention across 457, non-ERISA, and Empower’s Taft-Hartley segments. Dan’s focus on putting the client at the center of the conversation has helped Empower with an impressive 98.5% retention rate and strong organic sales growth. Previously Dan served as Vice President and Practice Leader for Empower’s not-for-profit segment.

Dan holds bachelor’s degrees in mathematics and English from the University of Vermont.

Christopher Nikolich, Head of Glide Path Strategies (US), Multi-Asset Solutions

Christopher Nikolich, Head of Glide Path Strategies (US), Multi-Asset Solutions

AllianceBernstein

Christopher Nikolich joined AB in 1994 and is the Head of Glide Path Strategies (US) in the Multi-Asset Solutions business, leading research efforts relating to the design and management of effective target-date and lifetime income fund solutions. He is the author of defined contribution (DC)-related research, such as Designing the Future of Target-Date Funds: A New Blueprint for Improving Retirement Outcomes. In addition, Nikolich has authored thought leadership focused on topics such as plan design, asset allocation, inflation and the design and evaluation of retirement income solutions. Nikolich also works closely with clients in the implementation of AB’s research to structure their customized target-date and lifetime income funds. He holds a BA in finance from Rider University, an MBA in finance from New York University, is the Vice Chair of Rider University’s Investment Subcommittee and is a member of the Executive Committee of the Defined Contribution Institutional Investment Association.

Mikaylee O’Connor, VP, Senior DC Strategist

Mikaylee O’Connor, VP, Senior DC Strategist

PGIM DC Solutions

Mikaylee O’Connor is a Vice President, Senior Defined Contribution Strategist for PGIM DC Solutions. Ms. O’Connor provides thought leadership to DC plans on plan design, investment structure and implementation, the implications of regulatory changes, and industry best practices. Ms. O’Connor also supports PGIM’s development of innovative solutions to help plan participants achieve their retirement income goals. Prior to joining PGIM, Ms. O’Connor was the Head of Defined Contribution Solutions for RVK, Inc.

Kristin O’Donnell, Director, Defined Contribution, Relationship Manager

Kristin O’Donnell, Director, Defined Contribution, Relationship Manager

Wellington Management

Kristin serves as a relationship manager on the Americas Institutional Relationship Management Team, focusing on servicing corporate defined benefit and defined contribution client relationships. As a relationship manager, she serves as a conduit for clients to ensure that the full range of resources and services of the firm are brought to bear on their behalf. In addition, as director of Defined Contribution Strategies, she is responsible for identifying, sharing, and acting upon the major trends occurring within the defined contribution marketplace. In this capacity, she is responsible for synthesizing information on defined contribution trends, developing thought pieces for internal and external use, and working closely with various groups at Wellington Management to ensure that the firm is well-positioned as a trusted resource and solutions provider for our clients.

Prior to joining Wellington Management in 2011, Kristin worked for Fidelity Investments as vice president in Consultant Relations for their defined contribution business (2006 – 2011). Prior to that, she worked for Mercer Investment Consulting (1997 – 2006).

Kristin earned her MBA from the University of Chicago Booth School of Business (2003) and a BBA in finance from the University of Iowa (1996). Additionally, she holds the Chartered Financial Analyst designation and is a member of the CFA Institute and the CFA Society Boston. She is also an active member of the Defined Contribution Institutional Investment Association (DCIIA) and since 2020 has served as a member of the Executive Committee at DCIIA.

AJ Padilla, Chairperson

AJ Padilla, Chairperson

City of Austin Deferred Compensation Committee & Lieutenant, Austin Fire Department

AJ Padilla is the Chairman for the City of Austin Deferred Compensation Committee, as well as an 18-year Lieutenant with the Austin Fire Department where he works in the Office of the Fire Marshal. As Chair, he oversees $700+ million in Plan assets. Since joining the 457 Committee in 2012, AJ has helped lower recordkeeping fees and streamline the core menu, as well as increase access to the Plan for City employees through education and targeted campaigns. While still keeping an eye on Plan features and fee structure, the focus of the Plan has transitioned to a comprehensive approach towards retirement by working with the various pension systems offered by the City of Austin so retirees can enjoy a more secure retirement. These efforts have won the 457 Plan numerous accolades, including NAGDCA Leaderships Awards in 2014 and 2016, 2018 and 2019, as well as Plan of the Year from Plan Sponsor in 2014 and an Innovation Award in 2020 from Pensions & Investments.

Jacob Peacock, Consulting Director

Jacob Peacock, Consulting Director

AndCo

As a Consulting Director at AndCo, Jacob leads a team of consultants in providing customized investment and fiduciary oversight for clients with institutional portfolios including defined contribution, defined benefit, endowments and foundations. He also contributes his experience to AndCo’s overall defined contribution strategy. Jacob is a frequent speaker at educational and industry conferences and actively participates on various related Committees. He is currently serving as an elected member of the NAGDCA Industry Committee which is focused on improving public sector retirement plans. He has spent his entire career in the retirement industry and brings a unique perspective with prior experience including participant-level education, corporate strategy, and business development. Prior to joining AndCo he held positions at Mercer and Wachovia (now Wells Fargo).

Matt Petersen, Executive Director

Matt Petersen, Executive Director

NAGDCA

Matt Petersen joined NAGDCA as the association’s first full time dedicated staff resource in the summer of 2017. In his role as Executive Director he works directly with the Executive Board and staff to develop strategies to help the organization achieve its mission and vision. Prior to joining NAGDCA Matt spent 13 years on active duty in the US Air Force as a C-17 evaluator pilot and air drop specialist, and served three deployments in support of Operations Iraqi Freedom and Enduring Freedom.

Matt is a graduate of the United States Air Force Academy. He also has a Master’s in Social Sciences from the Maxwell School of Public Affairs at Syracuse University, and an MBA from the Kellogg School of Management at Northwestern University.

Douglas Peterson, Chief Information Security Officer

Douglas Peterson, Chief Information Security Officer

Empower

Doug Peterson is the Chief Information Security Officer for Empower. He is responsible for cybersecurity strategy as well as architecture development and global cybersecurity. He has enterprise-level responsibility for all cyber/data/information security policies, standards, evaluations, roles and awareness for all utilized technologies, services, vendors and partners. He joined Empower in 2015 and has over 27 years experience in the financial services industry. Prior to Doug’s corporate career, he served in the U.S. Army as an Intelligence Analyst for the 82nd Airborne Division and the 19th Special Forces Group.

Doug holds a bachelor’s degree in business administration with a minor in international business. He is a Certified Business continuity Planner (CBCP) through DRI International, a Certified Information Security Systems Professional (CISSP) through the International Information Systems Security Certification Consortium (ISC2) and Information Security Systems Professional through Global Information Assurance Certification (GIAC). Doug is Board Chair for SPARK, the industry platform on security representing recordkeepers, consultants and asset managers.

Jim Potvin, Executive Director

Jim Potvin, Executive Director

Employees’ Retirement System of Georgia

Jim Potvin is the Executive Director of the Employees’ Retirement System of Georgia (ERSGA). He joined ERSGA in February, 2009 as the Deputy Director, after 15 years in private industry working in retirement plan administration and consulting. He was appointed as the Executive Director in February, 2012.

Jim began his career as a pension administrator for Georgia-Pacific Corporation, before moving into a consulting role with Arthur Andersen LLP. He later joined Hewitt Associates, a global HR consulting firm, as the Location Manager for the RFM Pension Administration outsourcing group. At ERSGA, Jim is responsible for the administration and operations of five defined benefit plans, two life insurance plans, and three defined contribution plans covering more than 120,000 active members and 75,000 retirees.

Jim holds a B.A. in Mathematical Economics and Managerial Studies from Rice University, and an M.S. from Georgia State University. He is a former president of the National Association of State Retirement Administrators, and a member of the NAGDCA, the National Conference of State Social Security Administrators, and the Government Finance Officers Association.

Mo Raihan, Chief Retirement Officer

Mo Raihan, Chief Retirement Officer

NYC Health + Hospitals

Assistant Vice President, Employee Benefits, for a company with more than 20 years progressive experience in strategic design and implementation of U.S. and global health and welfare, wellness, retirement, stock purchase, HR policy and ancillary benefit plans. An enthusiastic leader recognized for overcoming challenges and achieving desired results. Outstanding project management skills leading to success in implementing effective benefit strategies aligned with overall Human Resource initiatives.

James Reeves, Associate Director

James Reeves, Associate Director

State of New York

James Reeves is the current Associate Director for the New York State Deferred Compensation Plan and has been working for 15 years in various roles for the Plan including helping participants face to face in the field, and more recently helping to manage and guide the Plan’s future direction. He strongly believes in the power of well run DC plans to deliver better retirement outcomes for Plan participants at a lesser cost than they could obtain otherwise. He currently holds the CFP® and CRC designations, as well as a B.S. in Business from SUNY Fredonia and Associates Degree in computer science. He coauthored a published paper in PLI in 2019 discussing the retirement system frameworks of various countries and possible decumulation solutions.

Hutch Schafer, Vice President, Business Development

Hutch Schafer, Vice President, Business Development

Nationwide Financial – Retirement Solutions

Hutch Schafer is the Vice President, Business Development within Retirement Solutions at Nationwide Financial. The Business Development group is responsible for delivering competitive retirement plan solutions, guiding large scale programs and developing business strategies supporting the Corporate and Public Sectors. His past experience includes the development of various individual fixed and variable annuity products.

He is also the President of Nationwide Investment Advisors, LLC. Nationwide Investment Advisors offers various investment advisory programs, including a discretionary managed account service, to defined contribution retirement plans.

Hutch is a graduate of The Ohio State University with a Bachelor of Science degree in Mathematics and has been with Nationwide for 32 years. He has spent most of his career in Business & Product Development and Operations.

Hutch Schafer, Vice President, Business Development

Hutch Schafer, Vice President, Business Development

Nationwide Financial – Retirement Solutions

Hutch Schafer is the Vice President, Business Development within Retirement Solutions at Nationwide Financial. The Business Development group is responsible for delivering competitive retirement plan solutions, guiding large scale programs and developing business strategies supporting the Corporate and Public Sectors. His past experience includes the development of various individual fixed and variable annuity products.

He is also the President of Nationwide Investment Advisors, LLC. Nationwide Investment Advisors offers various investment advisory programs, including a discretionary managed account service, to defined contribution retirement plans.

Hutch is a graduate of The Ohio State University with a Bachelor of Science degree in Mathematics and has been with Nationwide for 32 years. He has spent most of his career in Business & Product Development and Operations.

Lynne Smith, SVP, Chief Client Experience & Technology Officer

Lynne Smith, SVP, Chief Client Experience & Technology Officer

MissionSquare Retirement

Lynne is responsible for aligning technology offerings and building best-in-class client experiences that support MissionSquare Retirement’s customers and the communities they serve.

Her extensive background includes leading nonprofit health care and education plan administration focused on participant and plan sponsor experiences by market segment, as well as building participant financial wellness and retirement readiness programs.

Lynne joined MissionSquare from OneAmerica where she served as Head of Business Development and Strategy. She has also served as Chief Operating Officer for Bank of Montreal and has held leadership roles with VOYA and CitiStreet.

She has a bachelor’s degree in Economics from Cornell University, and a master’s degree in Business Administration from the Frank G. Zarb School of Business at Hofstra University. She is a FINRA Series 7, 24, and 63 registered representative.

Vanessa Vargas Guijarro, Vice President

Vanessa Vargas Guijarro, Vice President

Segal Marco Advisors

Ms. Vanessa Vargas Guijarro is a Vice President in Segal Marco Advisors’ New York office with 18 years of experience in the investment industry. She provides consulting services to corporate and public defined benefit and defined contribution plans, foundations and endowment funds. Ms. Vargas Guijarro is the lead in a number of large defined contribution public plans.

Ms. Vargas Guijarro is a founding member of NEXT (National Exposure and X-Training), which is a professional development group for every non-officer at Segal who is interested in developing consulting skills. She is also a founding member of the KEY (Knowledge Empowers You) Committee at Segal Marco Advisors, which is a grassroots professional development initiative created to help employees learn from their colleagues; share ideas, understand roles and brainstorm effective solutions that meet client objectives. Ms. Vargas Guijarro is also a member of the Segal Diversity Equity and Inclusion (DEI) Steering Committee. The DEI Steering Committee supports Segal’s commitment by helping build on and enhance our existing programs and activities to nurture a workplace that is diverse and inclusive.

Karen Volo, Product Area Leader

Karen Volo, Product Area Leader

Fidelity Investments

Karen has spent her career helping employers across the country understand and address the unique financial needs of their employees at every life stage.

Karen and her team work with employers to provide actionable resources and planning support to help employees navigate their individual financial journeys, from first creating a plan that may entail paying down debt while still saving for other goals, to updating and building on that plan to incorporate more complex savings goals, investments and compensation packages, to ultimately achieving the retirement they dream of.

A 26-year veteran of Fidelity, Karen has previously held roles relationship management, program implementation and sales. She holds her Series 7, 24 and 63 securities registrations.

Karen lives in the Boston area with her husband Mike and their three children.

Sue Walton, SVP, Senior Retirement Strategist

Sue Walton, SVP, Senior Retirement Strategist

Capital Group | American Funds

Sue Walton is a senior retirement strategist at Capital Group, home of American Funds. She has 23 years of industry experience and has been with Capital Group for five years. Prior to joining Capital, Sue was a director at Towers Watson Investment Services. Before that, she was an investment consultant at Mercer Investment Consulting and Ellwood Associates. She holds an MBA from DePaul University with a concentration in finance and a bachelor’s degree in business administration, economics and international business from Marquette University. Sue is based in Chicago.

Brigen Winters, Principal, Chair Policy Practice

Groom Law Group

Brigen Winters counsels employers, plan administrators, financial institutions, insurers, trade associations, and coalitions on retirement, health and welfare, tax, executive compensation, regulatory, and legislative matters.

Brigen helps clients achieve compliance and obtain favorable outcomes through amendments from Congress and regulatory guidance from the IRS and Departments of Treasury, Labor, and Health and Human Services. He counsels clients on all aspects of tax-qualified and individual retirement plans, including plan design and administration, tax and ERISA, and pension plan funding issues.

His practice also includes the full range of laws that affect the administration of health and welfare benefit plans, cafeteria plans, health reimbursement, health savings and flexible savings accounts, retiree medical plans, private exchanges, and health funding arrangements. He works extensively on health care reform compliance, reporting, product design, and public policy matters related to the Affordable Care Act and American Health Care Act.

Brigen also counsels clients regarding the design and administration of executive deferred compensation plans, equity and long-term incentive plans, rabbi trust, and other funding arrangements including the design and administration of nonqualified deferred compensation plans, supplemental executive retirement plans, change in control and severance arrangements, employment agreements, bonus plans, and equity awards in compliance with IRC Sections 409A, 162(m), 3121(v), 83, 280G, and 457A.

Brigen chairs Groom’s Policy and Legislative Practice, and is a frequent speaker and writer on issues in the health, retirement, executive compensation, and tax areas.

Emily Wrightson, Principal

Emily Wrightson, Principal

CAPTRUST

Emily has over 15 years of experience in providing retirement plan consulting and advisory services to retirement plans across the country including state systems, cities, counties, and special districts. She specializes in conducting requests for proposals, recordkeeper implementations as well as working to ensure the successful delivery of recordkeeper services. In addition to recordkeeper selection and implementation work, Emily partners with clients in all aspects of the due diligence process, including investment analysis, plan design, compliance, regulatory, and process changes. Emily was recognized as a Top Woman advisor in 2021 and a Top Young Retirement Plan Advisor in 2022 by the National Association of Plan Advisors.